Open Credit Fund 3

What are the benefits?

The Incentive financial instrument Open Credit Fund 3 (OCF3) offers access to project finance on favourable terms at below-market prices to start up a new business or maintain and expand an existing one. Soft loans are offered to finance investments or working capital.

Who is eligible?

The loans are available to businesses of all sizes and entrepreneurs.

Applications are required to be submitted to:

- UAB „Medicinos bankas“

- Jonavos kredito unija

- Kauno kredito unija

- Kauno regiono kredito unija

- Klaipėdos kredito unija

- Kooperatinė bendrovė „Pilies“ kredito unija

- Kredito unija „Magnus“

- Kredito unija „Mėmelio taupomoji kasa“

- Kredito unija „Neris“

- Panevėžio kredito unija

- Šeimos kredito unija

- Tauragės kredito unija

- Utenos kredito unija

- Vilniaus kredito unija

- Vytauto Didžiojo kredito unija

How much?

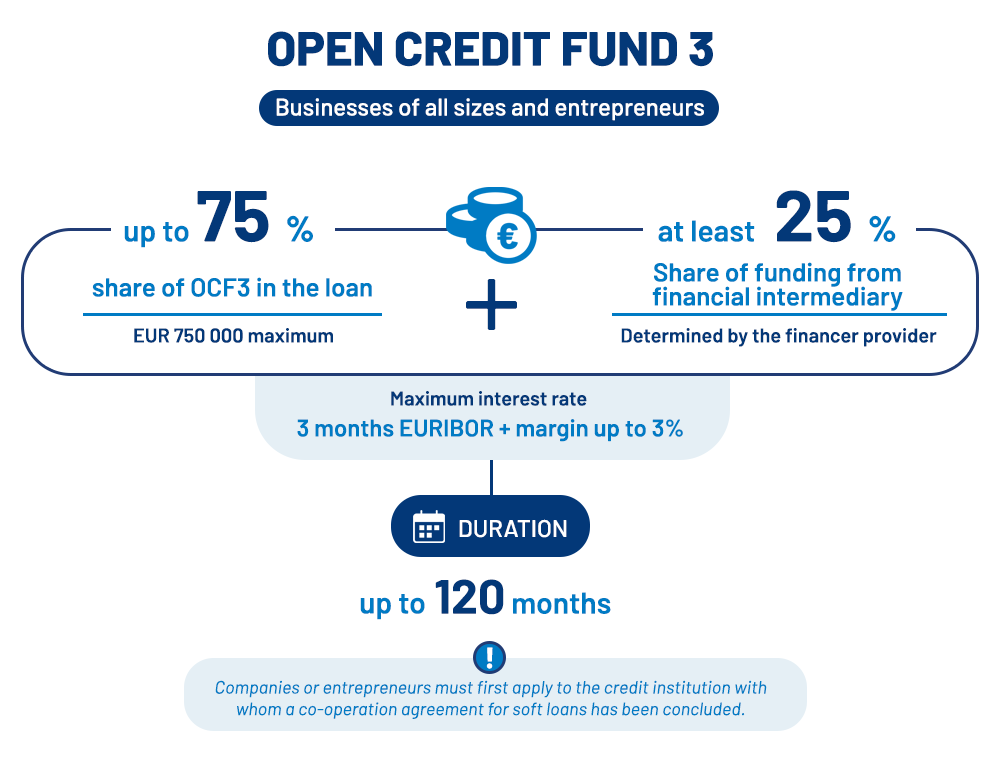

There is no limit for the maximum amount of the loan. The share of OCF3 per one loan must not be more than 75 per cent, and in any event may not be in excess of EUR 750 thousand. The share of the financial intermediator’s own funds per one loan must be at least 25 per cent.

There is no limit for the maximum amount of the loan. The share of OCF3 per one loan must not be more than 75 per cent, and in any event may not be in excess of EUR 750 thousand. The share of the financial intermediator’s own funds per one loan must be at least 25 per cent.

Maximum loan interest: 3 months EURIBOR + margin up to 3 %.

Amount from INVEGA available for AKF3: EUR 85.1 mio.

Time limits

Financing in the form of loan, credit line and lease will be provided for a maximum period of 120 months. If the term of the loan is less than 120 months, the time-limit may be extended, but in any event it may not be more than 120 months from the date of the initial loan agreement.

Financial intermediator may sign agreements with borrowers till the end of the eligibility period indicated in the description or until all of the funds available for the OCF3 instrument have been lent.

How does it work?

In order to benefit from the OCF3 instrument, companies or entrepreneurs must first apply to the credit institution with whom a co-operation agreement for soft loans has been concluded.

OCF3 funding may be provided in the form of a loan, line of credit and financial lease.

Lending to borrowers in the framework of the OCF3 Instrument is de minimis support which is subject to the provisions of Article 5 of Regulation (EU) 2023/2831 .

Loans for financing investments and/or working capital replenishment, where such financing is used to start up a new business or to maintain and expand an existing one.

Loans for investment means the loans where the share of the loan towards investment financing is at least 51 per cent of the total amount of the loan, while the remaining portion of the loan can be used to replenish working capital. In all other cases, a loan shall be deemed to be towards the replenishment of working capital.

- Financing or restructuring current financial liabilities of the borrower or other economic operator engaged in a business activity. Refinancing of the financial liabilities of the Borrower.

- The funds of the loan may not be used to pay dividends and tensions, reduce capital by disbursing funds to the participants in the Borrower, acquire treasury shares or make other payments from the capital to participants in the Borrower and/or physical and natural persons; the funds also may not be used to repay or grant Loans to participants in the Beneficiary or their related natural and legal persons.

- Immovable property development, i.e. to acquire and/or build immovable property, and/or invest in the upgrading of immovable property in order to sell, rent or otherwise transfer it to other natural and legal persons, rather than use it in its own operations.

- Acquire and/or build residential immovable property and/or invest in the material improvement of residential immovable property (building/structure) as defined in Article 2(20) of the Republic of Lithuania Law on Value Added Tax.

- A The loan is not intended to finance the following activities of the borrower: specialized retail trade of weapons and ammunition (activity code according to EVRK Rev. 2 subclass 47.78.30); production and/or wholesale of tobacco products (all activity codes according to EVRK rev. 2, chapter 12 and class 46.35), gambling and betting organization (all activity codes according to EVRK rev. 2, chapter 92), wholesale of distilled alcoholic beverages.