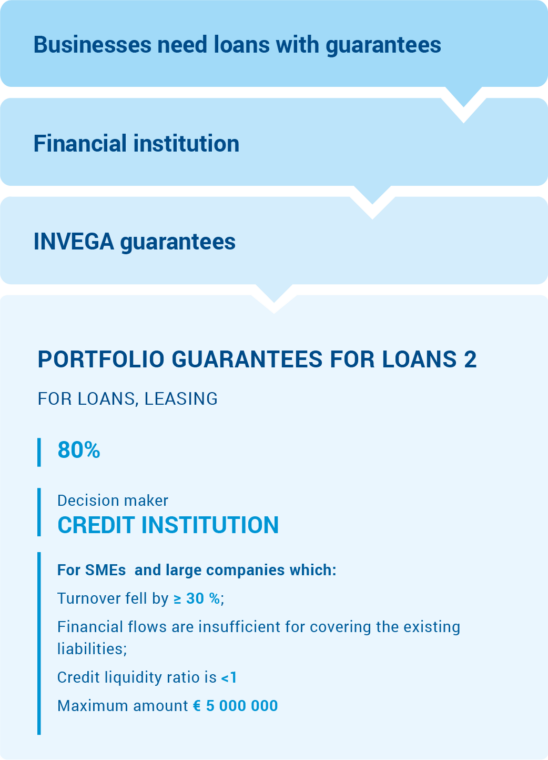

Instrument implemented Portfolio Guarantees for Loans 2

What are the benefits?

The incentive financial instrument Portfolio Guarantees for Loans 2 is targeted at companies facing shortages due to the COVID-19 outbreak. This instrument reduces financing risk and thus facilitates the availability of loans and leasing to improve corporate liquidity.

What companies are eligible?

Small and medium-sized business entities operating in the Republic of Lithuania and large enterprises, which on 31 December 2019 were not considered to be in difficulty, but were in difficulty in 2020 as a result of the outbreak of COVID-19, if one of the following conditions is met:

- the turnover decreased by at least 30%;

- the financial flows generated became insufficient to cover existing liabilities;

- the value of the emergency coverage (critical liquidity) ratio became less than 1.

- AB „Citadele Bankas Lietuvos filialas“

- AB „Mano bankas“

- AB „SEB bankas“

- AB „Swedbank“

- AB „Šiaulių bankas”

- Jungtinė centrinė kredito unija

- Lietuvos centrinė kredito unija

- Luminor Bank AS

- Medicinos bankas

- Rato kredito unija

- Pay Ray

- UAB „Citadele faktoringas ir lizingas“

- UAB Factris LT1

- UAB „Noviti“

- UAB „SME finance”

- UAB „Swedbank lizingas“

- Unicredit Leasing

What is the maximum amount?

It is planned to allocate up to EUR 85 million from the state budget of the Republic of Lithuania for the implementation of the instrument Portfolio Guarantees for Loans 2.

How does it work? Main conditions

Each loan or leasing transaction included in the portfolio of the instrument Portfolio Guarantees for Loans 2 is guaranteed by the 80% guarantee.

The guaranteed portfolio may include:

- working capital loans, including reverse leasing transactions, to support corporate liquidity, granted not earlier than on 16 March 2020;

previously signed unsecured investment (including leasing transactions) and working capital (excluding reverse leasing transactions) loans for which the repayment schedule was extended or the deferred repayment was applied, without compromising other loan repayment terms, not earlier than on 16 March 2020. - Guaranteed loans can be granted for the maximum period of 6 years (72 months).

The amount of the guaranteed loan depends on the amount of salaries accrued to the company’s employees during the year, the company’s turnover, investment and other liabilities, and the maximum amount may not exceed EUR 5 million.

Loans can be included in the guaranteed portfolio no later than until 31 December 2020.

The following loans may not be included in the guaranteed portfolio:

- if the borrower was a company in difficulty as of 31 December 2019.

- if the borrower is engaged in financial activities, except when the borrower is developing financial technologies.

- if the borrower is directly active in the production, processing and marketing of arms and ammunition, tobacco and tobacco products and distilled alcoholic beverages.

- if the loan is intended for the purchase of residential apartments and investments in the improvement of the condition of residential apartments.

- if the loan is intended for investments in companies engaged in the organization of gambling.

- funding may not be used to pay dividends, reduce capital by disbursing funds to the borrower’s participants, repurchase own shares or make other payments from capital to the borrower’s participants, nor may it be used to repay or grant loans to the borrower’s participants or persons related to them.