Startuok

| It is a translation of the description. Due to possible different interpretations because of differences in the languages, the Lithuanian approved legal act should be applied. |

What are the benefits?

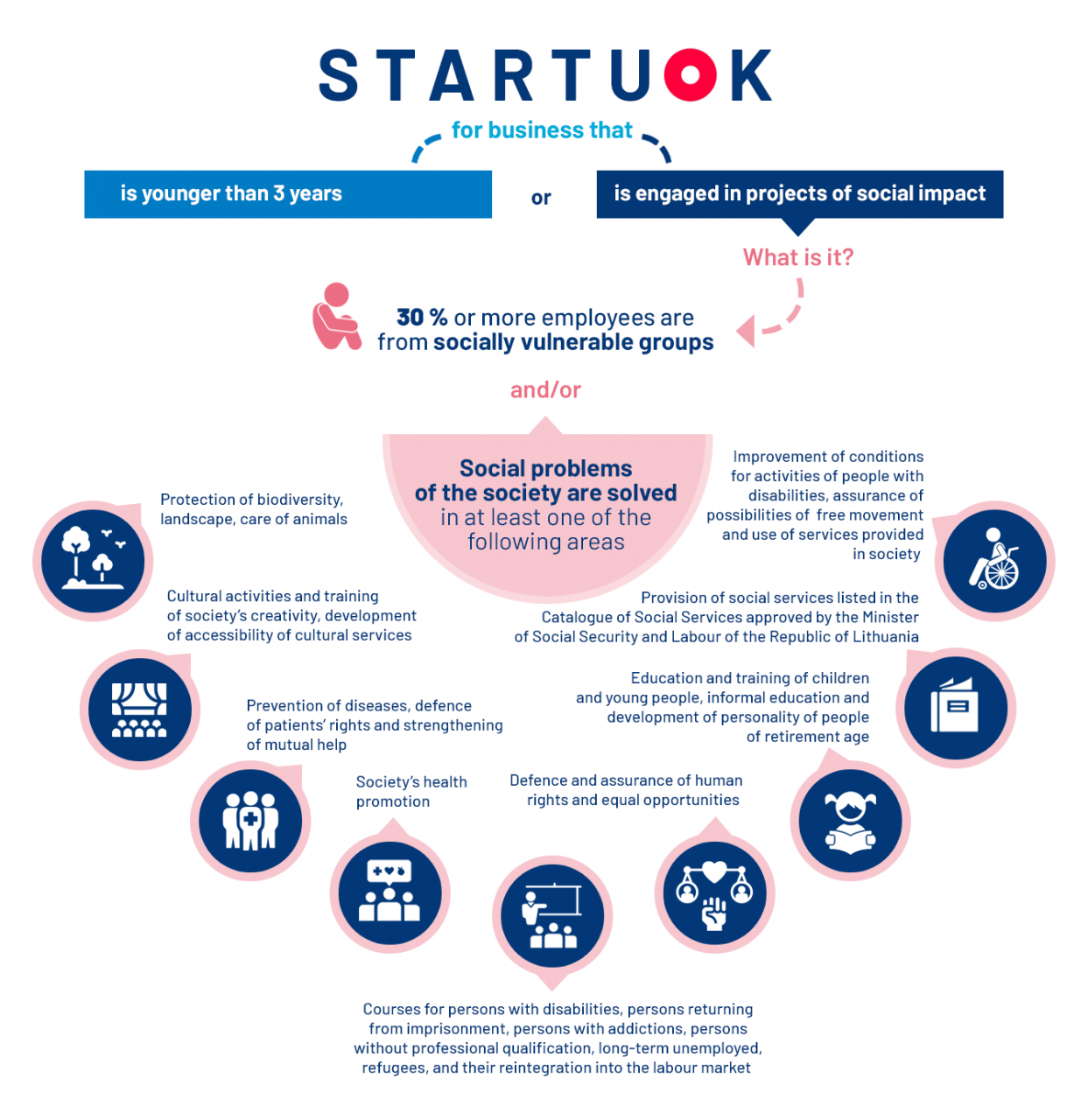

As INVEGA is granting loans “Startuok“ financed by the European Regional Development Fund, it attempts that the small and medium-sized business (hereinafter – SMB) undertakings operating not more than three years or conducting the social impact projects and operating not more than five years, and SMB undertakings that were established in Lithuania not earlier than on 24 February 2022, the stakeholder of which (shareholder, member, partner) or the owner of which is an Ukrainian citizen holding the Lithuanian residence permit or an Ukrainian legal entity that has been operating not more than five years, and have a reasoned business plan, would receive the necessary funds to finance their projects, when new activities are started or when it is endeavoured at strengthening or expanding the already present activities.

Who is eligible?

SMEs that comply with the SME status defined in the SME Law, and:

- That have been operating for the period not exceeding three years from the day of registration of an enterprise or self-employment;

or - That are implementing the projects of social impact and that have been operating for the period not exceeding five years from the day of registration of an enterprise or self-employment;

or - That were established in Lithuania not earlier than on 24 February 2022, the stakeholder of which (shareholder, member, partner) or the owner of which is a Ukrainian citizen holding the Lithuanian residence permit or a Ukrainian legal entity that has been operating not more than five years.

The application for loan shall be addressed to INVEGA. It shall be submitted together with the supporting documents via the application submission system (Lithuanian language version).

| Submitted documents and information | Self-employed businessman operating less than 3 years | Enterprises operating less than 3 years | Enterprises engaged in the projects of social impact and operating less than 5 years |

| Application | |||

| Declaration of SME status signed by a manager | |||

| Declaration of a single company* | |||

| Letter of the private sponsor intending to take part in the project (not applicable when all the funds covering the share of the private investor are those of the borrower. In such a case, such information has to be substantiated in the business plan) | |||

| Documents describing a business operator: registration documents, regulations, copy of the manager’s personal identity document, information about shareholders (owners, beneficiaries). Relevant structure of borrower’s shareholders and a document in a free form stating relations between the business operator and associated enterprises. | |||

| Registration documents on self-employment of the businessman, copy of the personal identity document, and a document in a free form stating relations between the businessman and associated enterprises | |||

| Business plan (in free form) | |||

| Clear and measurable key indexes of positive impact of social business have to be provided in the business plan of the company engaged in a project of social impact | |||

| Interim financial report of current financial year or equivalent documents if businessmen or enterprises have been operating for less than a year | |||

| Completed and signed Do No Significant Harm compliance questionnaire (Annex 3 ) | |||

| Financial state and forecasts of business operator (Annex No. 1 to the Description) | |||

| Decision of the business operator’s management body to receive a loan, to mortgage property, and to assign the persons authorised to enter into the contract with INVEGA |

* Declaration of a single company shall be submitted by a medium-sized, small or microenterprise operating less than five years.

More detailed information is provided in the Lithuanian version.

| The financed project has to be recognised as economically substantiated and paying dividends by INVEGA in the course of evaluation of the respective application. |

| You may apply for the loan if: | Mid-western Lithuania (MWL) region* | Capital region** |

|

You are a small or medium-sized business (SME) entity operating for up to 3 years, or an SME entity implementing social impact projects and operating for up to 5 years, o SME entity that were established in Lithuania not earlier than on 24 February 2022, the stakeholder of which (shareholder, member, partner) or the owner of which is a Ukrainian citizen holding the Lithuanian residence permit or a Ukrainian legal entity that has been operating not more than five years. |

||

| You are operating in the Republic of Lithuania. | ||

| The state and/or municipality does not own or owns less than 25% of the shares, stocks or other forms of participation in the company’s capital. | ||

| You are not active in the agricultural sector, and you are not engaged in fisheries and aquaculture activities. | ||

| You are not engaged in financial and insurance activities, unless you are developing financial technology. | ||

| The activities for which funding is applied for are not: specialized retail trade of weapons and ammunition, production and/or wholesale trade of tobacco products, organization of gambling or betting, wholesale trade of distilled alcoholic beverages. | ||

| In case of loans up to 25 000 euro, you are not a micro-, small enterprise or a businessman who satisfies the requirements of SME status and you have not been operating for less than 1 (one) year. | ||

| You satisfy the minimal criteria of reliable taxpayers. | ||

|

You are not an enterprise going bankrupt, while restructuring or liquidation. |

||

| You have not received illegitimate aid that would be recognised by the European Commission as illegal or incompatible with the internal market, or you have repaid its total amount, including interest, in accordance with the legal acts. | ||

| At the time of application, you are not a business in difficulty and you have submitted the set of financial reports of the 2 last financial year to the Centre of Registers (not applicable for SME that has been operating for less than 1 year). | ||

| You do not have, or have terminated, trade commitments with natural and/or legal persons from countries hostile to the Republic of Lithuania by 31 August 2022. | ||

| Those with the authority of representation or control must not have been convicted or sentenced for criminal offences concerning economic activity in the last five years and must have no criminal record associated with criminal offences, whether expired or not, where such specifically target the financial interests of Lithuania and the European Union. | ||

| The applicant and its beneficiary, or the natural and legal entities who will benefit from the loan, must not be subjected to any sanctions including trade, economic or financial sanctions, embargoes or other restrictive measures. | ||

| You do not have business relations with legal persons registered in territories which do not cooperate with the European Union in the application of internationally harmonized taxes under their jurisdiction, nor do you carry out or intend to carry out transactions with legal persons registered in the target territories; | ||

| The activity for which you are applying for funding is not carried out under Regulation (EU) No. 2021/1058 in the cases listed in paragraph 1 of Article 7. | ||

| In the last 5 years, you have not been found guilty by a final court decision or a final administrative decision, and you do not have an unexpired or unexpunged conviction for failure to fulfill obligations related to the payment of taxes or social security contributions. | ||

|

You have submitted all the required documents. |

* Alytus, Kaunas, Klaipėda, Marijampole, Panevėžys, Šiauliai, Tauragė, Telšiai and Utena counties.

** Vilnius County.

A borrower is not considered to be a business in difficulty if it is a micro- or small enterprise, if no collective insolvency procedure is applied for it, and if it has not received any rehabilitation or restructuring aid. Besides, the borrowers cannot be the entities going bankrupt, in the course of restructuring, and they have to satisfy other requirements.

All requirements are described in the description (Lithuanian language)

| Business operators | Micro- or small enterprise | Medium-sized enterprise |

| The loan is granted | According to the General Block Exemption Regulation | According to the Regulation de minimis |

| Applied provisions of the Regulation |

|

|

* Business undertakings that were established in Lithuania not earlier than on 24 February 2022, the stakeholder of which (shareholder, member, partner) or the owner of which is a Ukrainian citizen holding the Lithuanian residence permit or a Ukrainian legal entity that has been operating not more than five years.

** In compliance with the requirements of Paragraph 2 of Article 22 of the General Block Exemption Regulation.

How much?

Total budget allocated for the instrument is EUR 52,24 million.

| Business operator of less than 3 years | Business subject conducting the social impact projects and the Ukrainian companies | |

| Age of enterprise or self-employment | Up to 3 years | Up to 5 years |

| State aid | Applied | Applied |

| Interest rate of the loan | Discount of 50 percent from the price confirmed in the pricing | Discount of 70 percent from the price confirmed in the pricing |

| In case of investment financing | Loans up to 3 000 000 euro. Loan’s term is 120 months.* | |

| In case of supplementation of circulating assets | Loans up to 200 000 euro. Loan’s term is 36 months.* | |

* While there is no restriction on the number of loans per Borrower, the total outstanding loan balances under the Facility must not exceed EUR 3,000,000 for the same Borrower at any given time.

The loan’s interest is partially fixed. The share of partially fixed interest is determined according to the publicly available interest calculation methodology applied for loans granted by INVEGA. The interest rate is composed of an interest margin, determined by the Borrower’s risk level and the project to be undertaken by the Borrower, the size of the collateral securing the loan, the duration of the loan, the repayment schedule of the loan and a variable interest component based on the 6-month EURIBOR. The variable interest rate is established at the time of the loan agreement and remains fixed for a period of five years. After this period, the variable interest component is recalculated every 12 months.

At least 20 percent of the project’s expenses have to be covered by private sponsors, where at least 10 percent of the project’s expenses have to be covered from the borrower’s funds. The private sponsors may take part in the project by granting a loan to the borrower for the project’s implementation. Own funds of the borrower are also considered to be private financing.

|

Preliminary calculator of interest rate |

INVEGA evaluates the submitted application no later than within 30 working days, counting from the date of all correctly submitted documents.