Pokytis

INVEGA evaluates the submitted application no later than within 30 working days, counting from the date of all correctly submitted documents.

Applications are open for submission until 31 March 2029

What are the benefits?

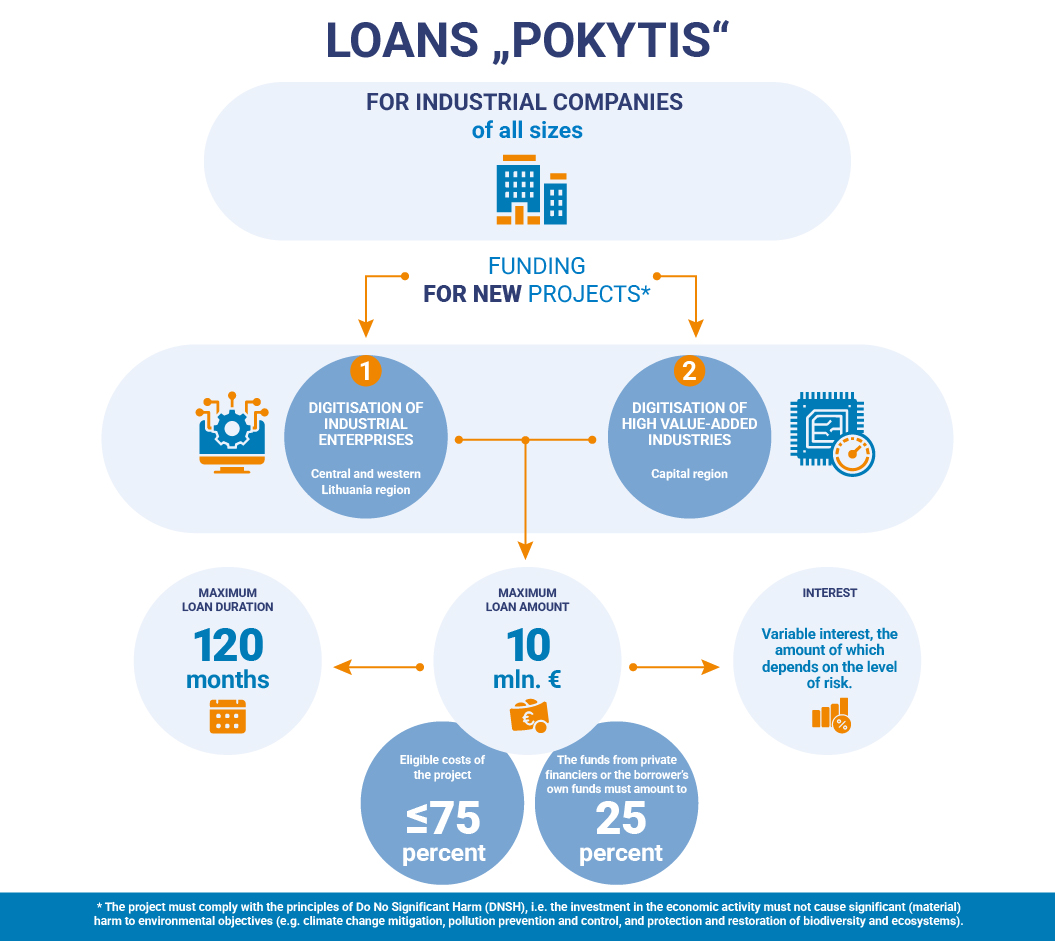

These loans are focused on transforming the Lithuanian economy and improving the competitiveness of businesses by investing in:

- automation of production processes in industrial enterprises and the introduction of digitisation technologies in the central and western Lithuania regions;

- digitising the production processes of high value-added industries in the capital region.

What companies are eligible?

Micro, small and medium-sized industrial enterprises can apply for loans.

Funding is provided for new projects that have not yet started and that comply with the horizontal principles and the EU Charter of Fundamental Rights.

| Mid-western Lithuania (MWL) region* | Capital region** |

|

|

| 3. The project introduces production process equipment (including production logistics) with at least one digital technology. | |

* Alytus, Kaunas, Klaipėda, Marijampole, Panevėžys, Šiauliai, Tauragė, Telšiai and Utena counties.

** Vilnius County.

The application for loan shall be addressed to INVEGA. It shall be submitted together with the supporting documents via the application submission system (Lithuanian language version).

Document forms are provided in the Lithuanian version of soft loans POKYTIS.

| Documents and information to be provided | Mid-western Lithuania (MWL) region* | Capital region** |

|

Application |

||

| Declaration of SME status signed by the head of the enterprise (except in the case of an application from a large enterprise with up to 3,000 employees) | ||

| Copy of the identity document of the company director | ||

| Single undertaking declaration (to be completed for aid granted under the de minimis regulation) | ||

| Up-to-date corporate and governance structure, i.e. consistent information on all levels of the corporate and governance structure, as well as on all natural and legal persons at all levels of the corporate ownership and governance structure | ||

| A free-form document setting out the relationship between the business entity and its related companies | ||

| The last quarterly interim set of financial statements for the current financial year, if 40 calendar days have elapsed since the start of the current quarter. In the case of companies operating for less than one year, an interim set of financial statements for the quarter preceding the last quarter, or equivalent documents, must be submitted if fewer than 40 calendar days have elapsed since the beginning of the current quarter | ||

|

Business Plan*** |

||

| Form detailing the activity (financial) data of the borrower | ||

| A letter of intent from the private financier to participate in the project (not applicable when the funds covering the private financier’s share are entirely borne by the borrower. In this case, the business plan must substantiate the origin of the loan recipient's own funds and provide documentation to support the origin of the own funds) | ||

| Three certificates of refusal to finance a business from different financial institutions****. The certificates must be submitted after INVEGA has assessed the application | ||

| Completed and signed Do No Significant Harm compliance questionnaire (Annex 5 to the profile) | ||

| Technological audit conclusion (recommendations for conducting a technological audit) | ||

| Services’ contract for the technological audit and (or) contract for technological oversight on the implementation of technological audit conclusions. ***** | ||

| Invoice for technological audit services and proof of payment ***** | ||

| Completed Annex 4 of the description justifying the project’s contribution to the Smart Specialisation concept | ||

| Completed Annex 4 of the description justifying the project’s contribution to the Smart Specialisation concept (where there is a desire to receive a grant) | ||

| A reasoned explanation of the changes that have occurred in the business entity’s activities and in the documents/data submitted with the application, and supporting documentation for the explanation, if the business entity is applying not for the first time (i.e. where the previous application(s) has been refused) | ||

| At the end of the project, the following must be submitted | ||

| Invoice for the technological supervision services provided for the implementation of the conclusion of the technology audit and proof of payment of the invoice **** | ||

| Certificate on the productivity indicator ‘Value added per employee’ in the prescribed format | ||

* Alytus, Kaunas, Klaipėda, Marijampole, Panevėžys, Šiauliai, Tauragė, Telšiai and Utena counties.

** Vilnius County.

*** The business plan shall include a description of the ongoing and/or planned activities, the current and projected financial position of the business entity, a proposal for the loan payment schedule and the loan security instruments, a description of the investments and the documents supporting the investments, if such documents supporting the investments exist. It must also include financial performance projections/estimates reflecting the ability of the business entity to make timely payments on all of the business entity’s existing and future financial obligations for the full term of the loan. It is suggested that the structure of the business plan recommended by the Innovation Agency is followed.

**** In all cases, at least one certificate must be signed by a bank licensed in the Republic of Lithuania (or a branch of a foreign bank licensed in the EU or the European Economic Area, and established in Lithuania) or an international institution, and at least one certificate must be signed by a finance company.

***** In cases where a grant is requested to cover such costs.

The submission, evaluation, conclusion or refusal of a loan agreement is governed by INVEGA's procedure for the submission and evaluation of applications and requests for direct loans.

Terms

Loan agreements shall be signed by 30 June 2029 and loan payouts shall be made no later than 31 December 2029.

How much?

Amount of funds committed under the financial instrument "Pokytis", co-financed by the European Regional Development Fund:

• EUR 49,477,735 for the digitisation of industrial enterprises in central and western Lithuania;

• EUR 99,065,421 for the digitisation of high value-added industries in the capital region.

The maximum loan amount is EUR 10 million. The maximum amount of the project’s eligible costs must be not more than 75% of the project’s eligible costs, 25% must come from private financiers or the borrower’s own resources.

Several loans may be granted to a single borrower, but the total amount of the loans may not exceed EUR 10 million.

The maximum duration of the loan is 120 months.

Application of state aid

| Company size | Region in which the investment takes place | Type of investment | Provisions of the applicable regulation |

| SME* | MWL**, Capital*** | Initial investment, Initial investment that creates a new economy activity | General Exemption Regulation (State aid under Article 14) |

| SMCE and MCE* | MWL** | Initial investment, Initial investment that creates a new economy activity | |

| Capital*** | Initial investment that creates a new economy activity | ||

| Capital*** | Initial investment | De minimis Regulation |

*An SME is a very small, small or medium-sized enterprise. An SMCE small mid-cap enterprise with no more than 499 employees and is not an SME. An MCE is a mid-cap enterprise with up to 3,000 employees and which is not an SME or an SMCE. For more details, see Annex 2 to the Description.

** MWL: Mid-western Lithuania (Alytus, Kaunas, Klaipėda, Marijampolė, Panevėžys, Šiauliai, Tauragė, Telšiai and Utena counties).

***Vilnius County.

How does it work?

In order to obtain a loan, one is to apply to INVEGA by submitting an application and related documents through the applications system (Lithuanian language).

You can apply for a loan if:

- You are based in the Republic of Lithuania;

- You meet the minimum criteria for a reliable taxpayer;

- You are not a company in bankruptcy, restructuring or liquidation;

- You are not a company in difficult situation at the time of application and you have submitted a set of financial statements for the last financial year to the Centre of Registers;

- The state and/or municipality does not own or owns less than 25% of the shares, stocks or other forms of participation in the company’s capital;

- You have not received state aid which has been declared unlawful and incompatible with the internal market by a decision of the European Commission and/or the lender, or you have repaid the full amount of the aid, including interest, in accordance with the procedure laid down by law;

- The applicant and its beneficiary, or the natural and legal persons for whose benefit the loan will be used, are not subject to sanctions (any trade, economic or financial sanctions, embargoes or other restrictive measures);

- The business entity, its manager, a member of its administrative, management and/or supervisory bodies, or a person having powers of representation, decision-making or control over the business entity, has not been convicted of any criminal offence and has no spent or unspent criminal record;

- You do not have business relations with legal persons registered in territories which do not cooperate with the European Union in the application of internationally harmonised taxes under their jurisdiction, nor do you carry out or intend to carry out transactions with legal persons registered in the target territories;

- You have provided evidence that you do not have access to market funding;

- You do not have, or have terminated, trade commitments with natural and/or legal persons from countries hostile to the Republic of Lithuania by 31 August 2022;

- You have submitted all the required documents.

All requirements are described in the description (Lithuanian language)

Loan interest

Loans are granted at a variable annual interest rate determined in accordance with the pricing methodology for loans granted directly by INVEGA and calculated in accordance with the indicative interest rate calculator approved by order of INVEGA’s Chief Executive Officer.

The interest rate on the loan is:

The interest margin, which depends on the borrower’s credit risk rating, the size and liquidity of the loan collateral, the maturity of the loan and the loan repayment schedule. A discount is applied to the interest margin set, which may not exceed 50%.

The variable interest rate component is 6-month EURIBOR (when EURIBOR is negative, it is zero).