Plans to form the Defence Investment Fund to invest in innovative companies in the field of defence and security

The national development institution Investment and Business Guarantees (INVEGA) together with the Ministry of National Defence of the Republic of Lithuania (KAM) is preparing to form the Defence Investment Fund (GIF) designed to accelerate the development of the defence and security industry ecosystem in Lithuania. This venture capital fund will enable the state to encourage the creation of new businesses with innovative ideas and help the growth of existing companies that have managed to introduce their products and services related to defence and security to the Lithuanian market.

“It should be recognised that the current defence and security industry ecosystem in Lithuania is still developing and can be stronger and more active, therefore we have refined the idea of a new Defence Investment Fund together with the Ministry of National Defence and are taking the first bold steps towards its establishment,” said Kęstutis Motiejūnas, Head of INVEGA – “Because small companies and start-ups still face challenges in finding financing, we feel a great responsibility in developing this fund’s investment strategy not only to ensure that funds are invested in business, but also to take care of potentially viable projects that often do not receive the necessary attention due to high risk or long payback period,” he continued.

According to Motiejūnas, INVEGA, which has experience in dealing with the establishment of a venture capital fund, observes the increasing rapid growth of interest of companies and investors in financing offered by such funds – businesses more and more often discover and appreciate the support offered by the acceleration funds, where investment is made more than just in a company, but also providing product, sales development, team building, attracting further investment, and other knowledge. With the establishment of the GIF, the defence and security companies will be overseen by a venture capital fund manager from the start of the business model development to the launching of the final product. They will be able to consult with investors, security and defence industry experts, who will help accelerated grow of the business and ensure the expected return on investment for the fund.

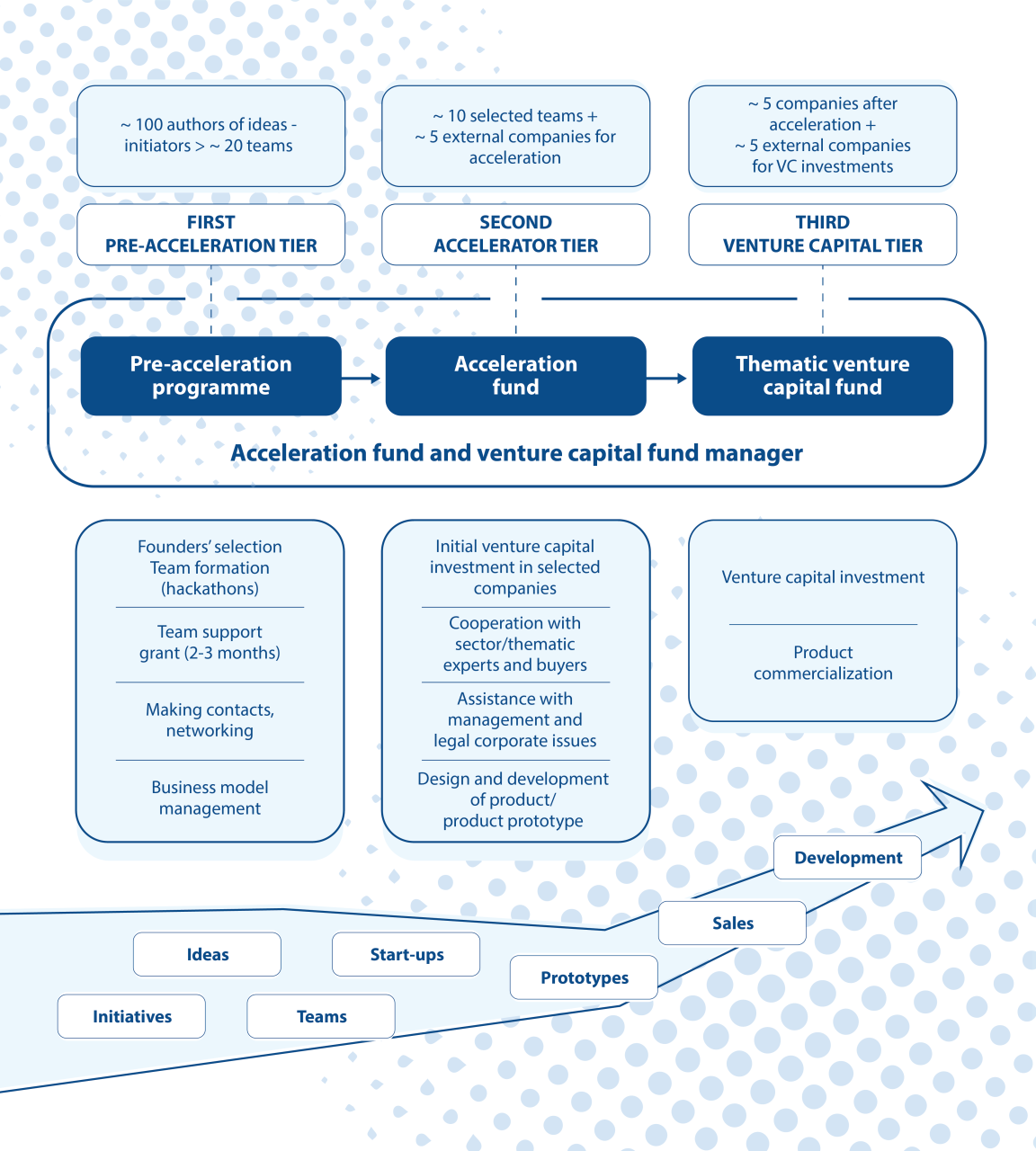

Under the prepared GIF investment strategy, the young or emerging defence and security companies will receive a 3-tier support aimed to provide the knowledge and investment they need to survive. Tier I or pre-acceleration tier will focus on team building, development of new ideas and products, and evaluation of the emerging business model in the market. Tier II or accelerator tier will provide acceleration services and initial small venture capital investments in product design, development and marketing. Meanwhile, Tier III or venture capital fund tier will focus on investment in companies to grow them and receive a return on investment.

Following signing of the GIF agreement, preparations will be made for the selection of a venture capital fund manager. The selected venture capital fund manager will be expected not only to be directly involved in the 3-tier procedure in providing practical business development and decision-making support, but also make efforts to attract additional funding from independent private investors.

“Although the development of new financial instruments requires considerable time and effort, the GIF investment strategy is already in place, and we expect to sign a GIF financing agreement in the near future. We hope to establish the fund before the end of this year,” concluded Motiejūnas.