Instrument implemented Direct loans to business entities affected by the war

| For applications submitted from 12 July 2023, the changes will apply in accordance with the approved new version. |

What are the benefits?

The instrument is intended to reduce the impact of the crisis caused by the Russian Federation's military aggression against Ukraine by providing loans to the working capital of business entities, and to reduce the lack of investment loans in the Lithuanian economy caused by this crisis.

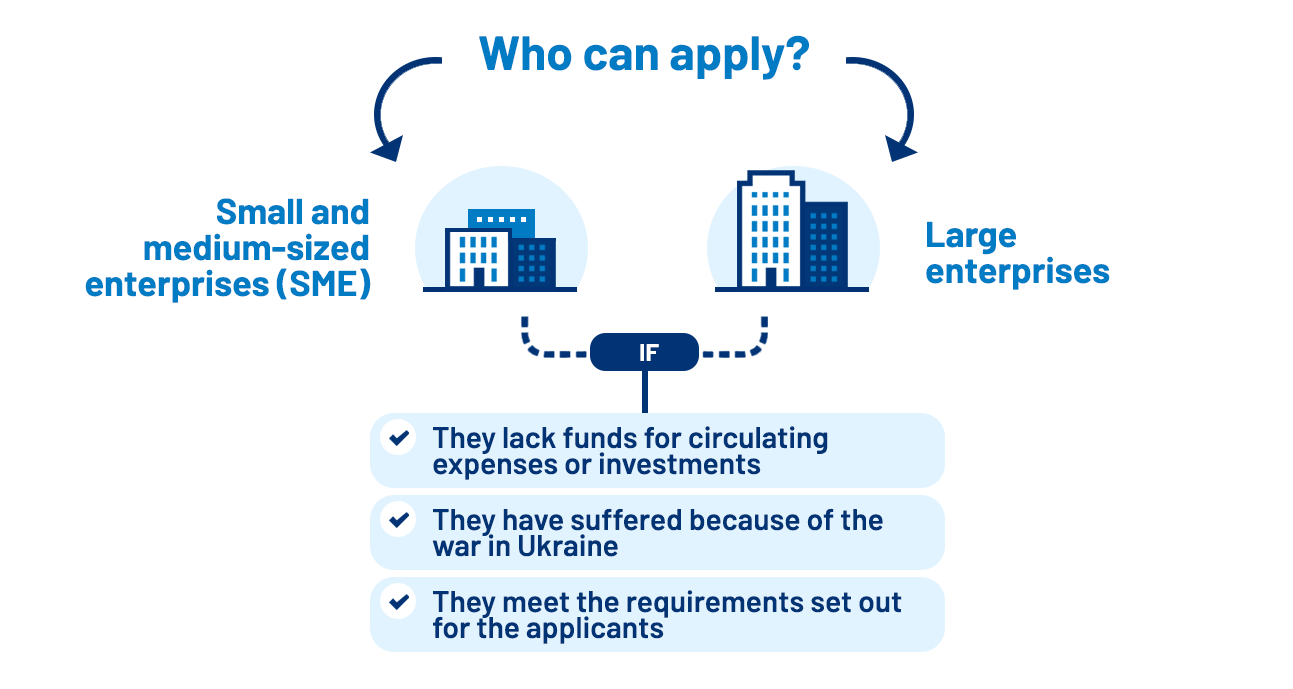

Who is eligible?

Small and medium-sized enterprises (SMEs) as well as large companies that meet the requirements for applicants may apply for a loan.

A borrower is considered a victim of a war-induced crisis if it meets any of the following conditions:

- The borrower’s share of imports and/or exports with Ukraine and/or imports with Russia and/or Belarus in aggregate is at least 15% of the borrower’s 2021 sales revenue;

or - The borrower’s energy costs, i.e. natural gas, heat and electricity supply, are at least 8% of the borrower’s costs in 2021;

or - According to the data of the State Data Agency as of 1 January 2022, the main economic activity carried out by the borrower within the meaning of Article 2(3) of the Law on SMEs, the type code of which is indicated in the Statistical Register of Enterprises, is included in Annex I to the European Commission’s Communication of 9 March 2023, Communication No 2023/C 101/03 on ‘Temporary framework of measures of State aid to support the economy in the context of the crisis and transition in response to the aggression of Russia against Ukraine’ (the ‘Communication’)*.

*Replacing Communication No 2022/C 426/01 of the European Commission of 28 October 2022, which replaced Communication No 2022/C 131 I/01 of the European Commission of 23 March 2022.

Previous versions of the instrument description:

- Schedule of Conditions (valid from 6 April 2023 to 11 July 2023)

- Schedule of Conditions (valid from 16 December 2022 to 5 April 2023)

- Schedule of Conditions (valid from 4 October 2022 to 15 December 2022)

For a loan, you need to apply to INVEGA by submitting an application and related documents through the electronic application system.

| Information and documents to be submitted | Working capital loan | Investment loan | ||

| SMEs and large companies | Entrepreneurs carrying out individual activities | SMEs and large companies | Entrepreneurs carrying out individual activities | |

|

Application |

||||

| Documents describing the borrower: incorporation (activity) documents of the legal entity, copies of the personal identity document of the manager, information about the participants of the legal entity (shareholders, owners, beneficiaries), the relevant shareholder structure of the borrower and a free form document specifying the business entity and the relations of its related companies | ||||

| Registration documents of the entrepreneur's individual activity, a copy of the personal identity document and a free-form document indicating the relationship between the entrepreneur and his/her related companies | ||||

| Business plan (description of the investment project), prepared in accordance with the requirements for a business plan recommended by Inovacijų agentūra | ||||

| Form detailing the activity (financial) data of the borrower | ||||

| The decision of the management body of the business entity, the competence of which is to make the relevant decision, regarding obtaining a loan, pledging assets and appointing persons authorised to sign relevant contracts or transactions | ||||

| Financial documents for the last three financial years or a shorter period (if the borrower has been operating for less than three years) | ||||

| Invoices issued to the borrower for the provision of energy services during the year 2021, where the damage caused due to the crisis caused by the war is based on Clause 4.2 of Section 2.2 or Clause 4.2 of Section 2.3 of the description | ||||

| Invoices (documents proving the experience of energy costs) issued to the borrower during the last 12 months before the month of submitting the loan application, if the borrower wishes the loan amount to be calculated according to Clause 1.2 of Section 2.2 and Clause 1.2 of Section 2.3 of the description. If the borrower has been operating for less than 12 months, then the possible size of the loan amount shall be calculated based on the period in which the borrower has been operating up to the date of application | ||||

| Interim report of the current financial year – financial report of the last quarter, if 40 calendar days have not passed since the current quarter, the financial report of the previous quarter must be submitted (if an entrepreneur is applying for a loan, he/she may submit equivalent documents) | ||||

| Reasoned explanation of the changes in the activities of the business entity and in the documents (data) submitted with the application, as well as supporting documents, when the business entity does not apply for the first time (i.e. when the previous application (s) were rejected) | ||||

|

Confirmation that the business entity does not have any or has terminated trade obligations with natural persons and/or legal entities of Russia and/or Belarus by 31 August 2022 |

||||

| Declaration (Annex 1 of the description), which declares loans granted to the borrower and/or leasing transactions (including guaranteed loans and/or guaranteed leasing transactions) in accordance with the measures implemented in accordance with the Communication | ||||

|

A letter of the private sponsor about intention to take part in financing of the investment project signed by a qualified electronic signature of the manager. |

||||

* If an application is submitted by an authorised person, a power of attorney has to be signed by a qualified electronic signature of the manager and the personal identity document of the authorised person has to be submitted.

** Upon request of INVEGA, the sponsor has to prove its financial capacity to take part in the investment project and to justify the origin f own funds. If the investment borrower intends to use own funds for financing of the investment project, this information has to be substantiated in the business plan.

The completed form must be submitted in Excel format and signed with a qualified electronic signature. We recommend signing documents in Excel and other formats in Signa Web, which can also be signed in the Electronic Archive Information System at https://adoc.archyvai.lt/eais-lpp/app/create or through the Dokobit system at https://app.dokobit.com/.

Standard Revolving Loan Agreement

Standard Investment Loan Agreement

Recommended form of mandate template

Loan or Partial Repayment Request Form*

*To be completed if the intention is to repay the loan or part of it in advance and repay the loan in a different way than the contractual terms.

**To be completed in the case of disbursement of an investment loan. Payment requests are made by sending them to operacijos@invega.lt. Payment requests will only be considered if they are received from the borrower’s e-mail address specified in the contract or application. The payment request must be duly signed.

The borrower wishes to change the terms of the Loan Agreement or to make a request related to the terms of the Loan Agreement (e.g. to pay dividends, to be allowed to take on additional liabilities):

Log in to the application system, select ‘Initiate a change to the terms and conditions of the agreement’, and submit a reasoned, free-form request in the window that opens, stating the purpose of the request. The borrower also has the possibility to attach documents related to the request. Once the request has been submitted, the borrower shall be informed by e-mail of the further progress of its assessment.

Terms

Loan applications are accepted until 10 November 2023.

The loan agreement must be signed by 20 December 2023.

How much?

EUR 50 million of funds from the INVEGA fund have been allocated for the implementation of the instrument.

Working capital loan

The proceeds of the working capital loan must be used no later than six months from the date of disbursement. Upon expiry of the deadline, the unused amount of the working capital loan must be repaid by the borrower to INVEGA no later than 10 working days after the expiry of the deadline.

Investment loan

The disbursement of the investment loan shall take place no later than 12 months from the date of conclusion of the contract and no later than 31 December 2024. In the case of construction or contracting works (including reconstruction), the loan proceeds shall be disbursed no later than 24 months and no later than 31 December 2025.

The maximum loan amount shall be calculated in accordance with the following provisions:

- the loan amount must not exceed 15% of the borrower's average sales revenue of the last 3 financial years;

or - the loan amount must not exceed 50% of the amount of the borrower's energy costs incurred in the last 12 months prior to the month of submitting the loan application.

- the loan amount granted to a borrower or a group of companies (if the borrower belongs to a group of companies) cannot exceed EUR 10 million.

| Only one working capital loan may be granted to one borrower and only one investment loan may be granted for the financing of one investment project. The amount of the granted working capital/investment loan cannot be increased. |

Interest on loans

Loans are granted at a fixed annual interest rate.

The interest rate of the loan is calculated according to the interest rate calculator approved by order of INVEGA’s CEO, which is prepared in accordance with the methodology for calculating the interest rate of loans granted directly by INVEGA.

The interest rate on the loan will not be less than 5%.

Preliminary interest rate calculator |

| Working capital loan | Investment loan | |

| Borrower |

|

|

| Purpose of the loan | The loan is granted to finance working capital, except for ineligible expenses. | The loan may be used to finance the acquisition of tangible fixed assets (buildings, plant, machinery and equipment), including the reconstruction of own tangible fixed assets, as well as the acquisition of land, where the investment in the acquisition of land is directly linked to the production of the products/goods and/or services to be produced, and/or intangible fixed assets which do not have a physical or financial form (patents, licences or other intellectual property). |

| Collateral | The loan may be subject to loan collateral. | A financed non-current asset or other equivalent non-current asset must be pledged in favour of INVEGA. |

| Loan deferral period | Up to 6 months + 6 months With INVEGA's consent. | Up to 24 months |

You may apply for a loan if:

- You are a small and medium-sized enterprise (SME) or a large company.

- You do not carry out activities attributed to the financial sectors.

- You do not have or have terminated commercial relations with natural persons and/or legal entities of Russia and/or Belarus no later than by 31 August 2022.

- You are a victim of Russia's military aggression against Ukraine.

- You operate in the Republic of Lithuania.

- You meet the minimum criteria for reliable taxpayers.

- At the time of application submission, you have submitted to the Centre of Registers a set of financial statements for the last three financial years or a shorter period (if the borrower has been in business for less than three years), in which the composition of equity is disclosed in detail. If you are an entrepreneur, you must submit financial documents to INVEGA for the last two financial years or a shorter period (if you have been operating for less than three years).

- You have not received illegal aid, which was recognised as illegal and incompatible with the internal market by the decision of the European Commission, or you have returned its full amount, including interest, in accordance with the procedure established by law.

- You are not a state and municipal enterprise in which 25% or more of the capital shares or the votes of the participants are individually or jointly owned by the state and/or municipality.

- You are not undergoing bankruptcy and/or restructuring or you are not an entrepreneur against whom a personal bankruptcy case has been initiated.

- You justify the need to get a loan.

- Sanctions (any trade, economic or financial sanctions, embargoes or other restrictive measures) are not applied to the borrower and its beneficiary, or to natural person and legal entities for the benefit of which the loan shall be used.

- You have not received funding under the incentive financial instrument "Loans Intended to Ensure Liquidity of Economic Entities Active in the Production, Processing and Trade of Agricultural and Fishery Products in Response to Russian Aggression against Ukraine".

- The risk of default of the borrower and/or the loan is of an acceptable risk level according to the methodology approved by INVEGA.